✅ Pros of Buying

-

Builds equity – You’re investing in your future, not a landlord’s.

-

Appreciation potential – Home values often rise over time.

-

Stable payments – With a fixed-rate mortgage, your principal & interest stay the same.

-

Tax advantages – Possible deductions for mortgage interest and property taxes.

-

Creative freedom – Remodel, paint, rent it out—your rules.

-

Long-term wealth building – One of the most proven paths to net worth growth.

❌ Cons of Buying

-

Upfront costs – Down payment, closing costs, inspections.

-

Maintenance & repairs – You’re responsible for everything that breaks.

-

Less flexibility – Harder to move quickly.

-

Market risk – Values can fluctuate short-term.

-

Property taxes & insurance – Ongoing costs renters don’t pay.

🏢 Pros & Cons of Renting

✅ Pros of Renting

-

Lower upfront costs – Usually just first month + security deposit.

-

Flexibility – Easier to relocate for work or lifestyle changes.

-

No maintenance stress – Repairs are the landlord’s problem.

-

Predictable short-term expenses – No surprise roof or HVAC bills.

-

Good for testing an area – Try a neighborhood before committing.

❌ Cons of Renting

-

No equity – Monthly payments don’t build wealth.

-

Rent increases – Payments often rise every year.

-

Limited control – Restrictions on pets, painting, or upgrades.

-

No tax benefits – Unlike homeownership.

-

Less long-term security – Lease can end, owner can sell.

🔑 Quick Decision Guide

You might be better off BUYING if you:

-

Plan to stay 3–5+ years

-

Want to build wealth

-

Have stable income

-

Want full control over your space

You might be better off RENTING if you:

-

Expect to move soon

-

Want minimal responsibility

-

Are rebuilding credit

-

Need maximum flexibility

✅ Why BUYING Makes Sense in Myrtle Beach & Grand Strand Market

1. Strong Appreciation + High Demand

-

Coastal inventory stays competitive.

-

Beach access, golf, and tourism keep demand high year-round.

-

Many buyers build equity faster here than inland markets.

2. Rental Income Potential

-

Short-term and long-term rentals are in demand.

-

Investor-friendly condos, golf course homes, and townhomes can offset mortgage costs.

-

Many owners use their home part-time and rent it the rest of the year.

3. Fixed Housing Costs vs. Rising Rents

-

Rent prices continue to climb with tourism growth.

-

Buying locks your payment while renters face annual increases.

4. Lifestyle + Wealth at the Same Time

-

Ocean breezes, golf, boating, dining, walkable communities.

-

You’re not just buying shelter—you’re buying a lifestyle and an asset.

5. Out-of-State Buyer Advantage

-

Compared to many northern markets, Myrtle Beach offers:

-

Lower purchase prices

-

Lower property taxes

-

More home for the money

-

❌ Challenges of Buying in Myrtle Beach (What Buyers Should Know)

-

Insurance costs: Coastal wind & flood insurance can be higher.

-

HOA fees: Common in condos and resort-style communities.

-

Maintenance: Salt air is tough on HVAC, roofs, and exterior materials.

-

Short-term rental rules: Some communities restrict rentals—this must be verified before buying.

-

Seasonal competition: Spring and summer bring more buyer activity.

✅ Why RENTING Can Make Sense in Myrtle Beach

-

Trying the beach lifestyle first before committing

-

Relocating for work and still learning the area

-

Waiting on credit improvement or down payment

-

Seasonal residents who only live here part-time

-

No maintenance responsibility in storm season

❌ Why RENTING Often Hurts Long-Term Buyers Here

-

No equity in a fast-growing market

-

Seasonal rent spikes (especially near the beach)

-

Limited inventory for long-term rentals

-

Pet restrictions

-

You’re helping your landlord build wealth instead of yourself

🧠 Myrtle Beach Buyer Decision Cheat Sheet

Buying is often better if you:

✅ Plan to stay at least 2–3 years

✅ Want long-term appreciation

✅ Are open to rental income

✅ Want payment stability

✅ Want coastal lifestyle without rising rent

Renting may be better if you:

✅ Are here short-term

✅ Are job relocating

✅ Are fixing credit

✅ Want zero maintenance

✅ Are unsure what area fits your lifestyle

💡 Local Buyer Insight

Many Myrtle Beach buyers:

-

Start as renters

-

Realize rent keeps rising

-

Then switch to ownership within 12–24 months

And often wish they had bought sooner.

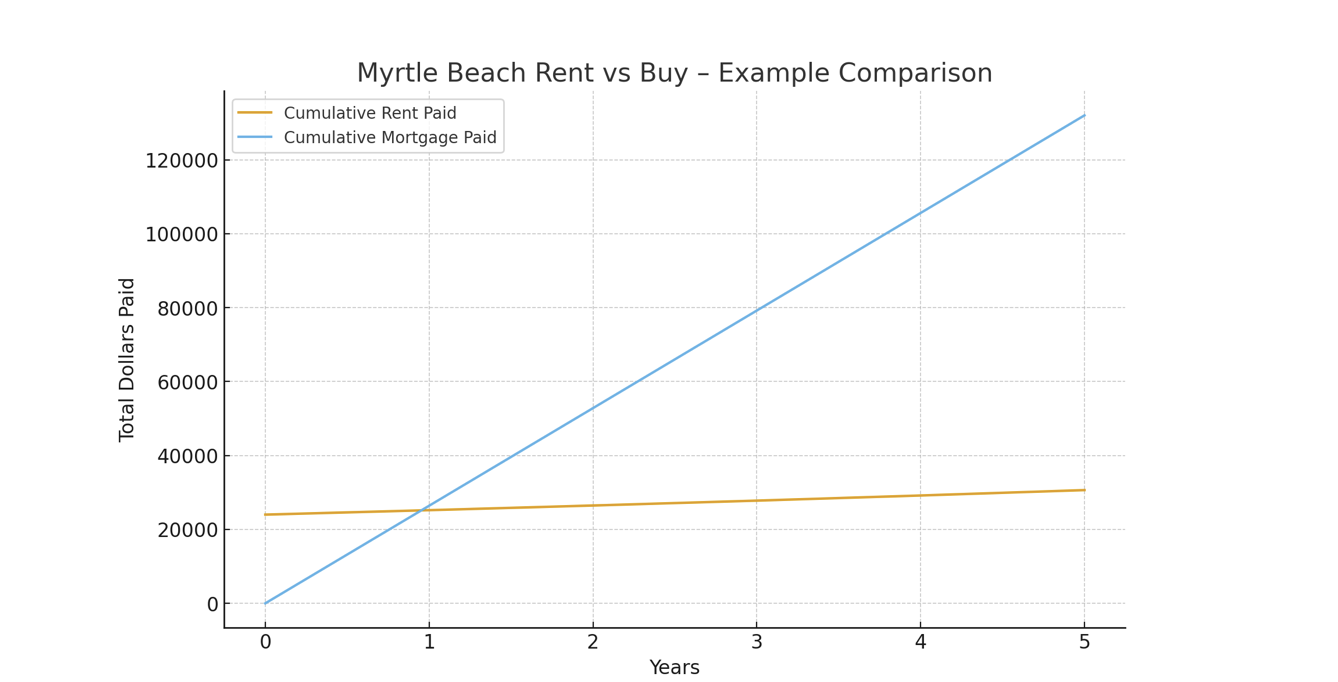

Rent vs. Buy comparison graph for the Myrtle Beach market showing:

Rent vs. Buy comparison graph for the Myrtle Beach market showing:

-

📉 Cumulative rent paid with annual rent increases

-

📈 Cumulative mortgage payments with a fixed payment

This helps visually show how rent keeps rising while a mortgage stays predictable—and where the break-even mindset starts to shift toward buying.

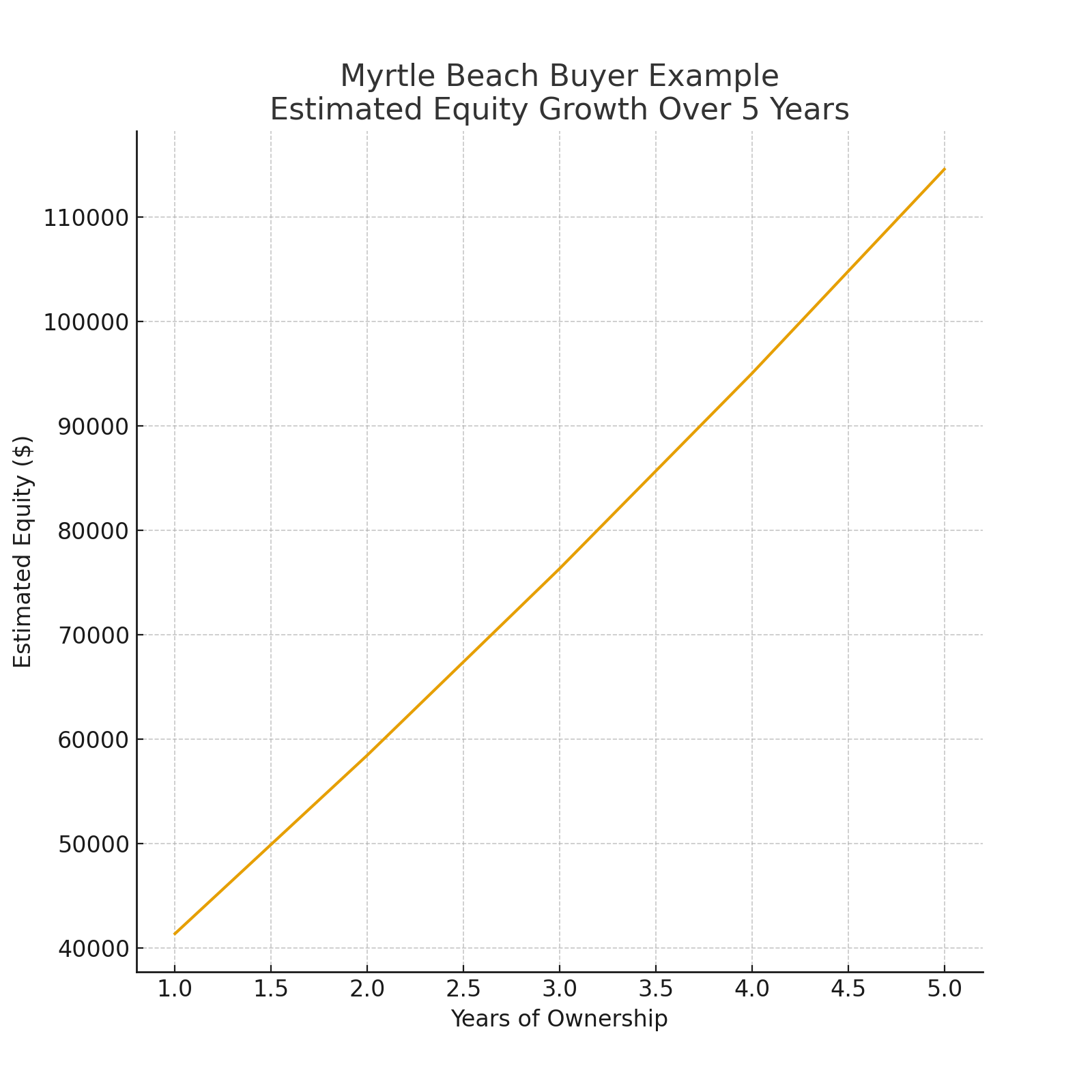

Equity Growth graph

Example Myrtle Beach purchase at $325,000

-

$25,000 down

-

6.5% rate

-

4% annual appreciation

-

Visual equity growth over 5 years